Where have all the lenders gone?

No lending, no need to borrow.

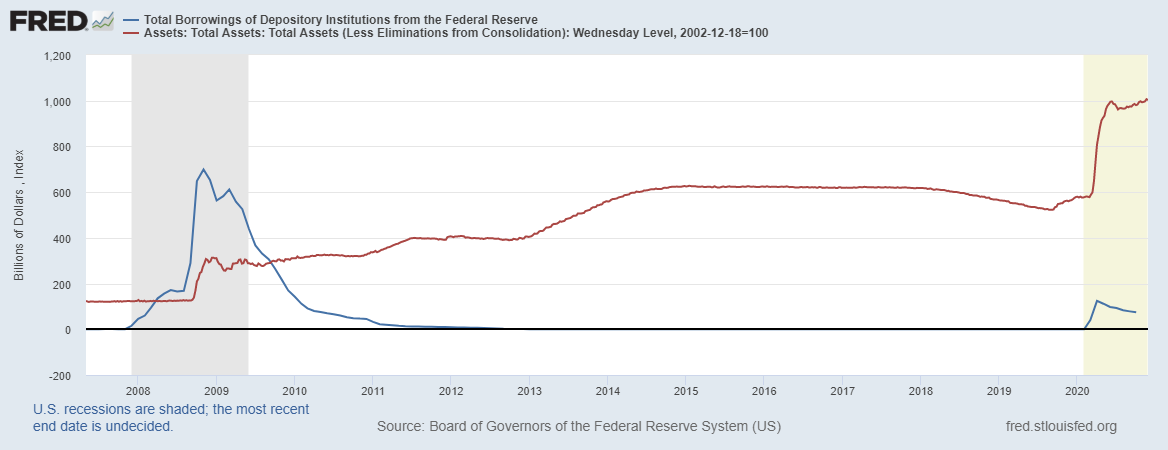

During the GFC banks needed liquidity, so the Fed came to the party with bail outs and loan collateral.

Now the banks have drunk too much and they don’t want to lend, so they don’t borrow either.

The chart below shows the Fed’s money creation (red) versus bank borrowings from the Fed.

It’s a tale of two planets.

Today, banks only lend to the strongest credits, and despite there being no more base level reserve requirements, they have deposited ~$3 trillion with the Fed. And as mentioned before, the Fed pays interest on those deposits.

Gone fishing on the Fed’s dime.

That’s where the lenders have all gone - fishing.

Can you imagine how much lending to small and medium businesses there would be if the Fed charged depositary institutions 2%, instead of paying them?

That’s right, materially negative interest targeted at Fed depositing banks would avoid negative rates for everyone else. It might also avoid a lot more printing of lazy collateral. Perhaps that might bring some confidence back into the world’s reserve currency, and the fiat experiment.

Is it just me?

Mike.

Next Level Corporate Advisory is a leading M&A and growth capital advisor with a multi-decade track record of providing high quality independent advice, as well as finding, creating and arranging transformative transactions.

All text in this article is copyright NextLevelCorporate.