China strikes back.

Slowdown.

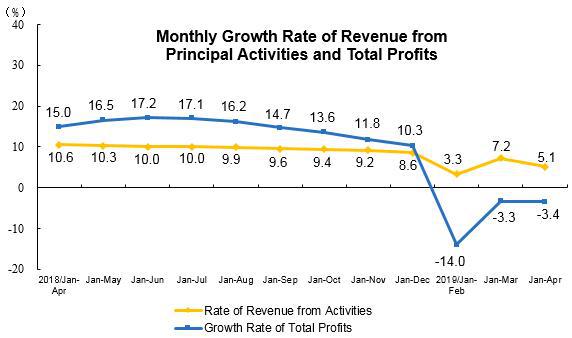

Wind the clock back a year or so, and Industrial profits in China (for significant businesses) printed a growth rate of 10.6% for the period Jan-April 2018.

This year, Industrial profits declined by 3.4% over the same period, with the bulk of the decline across January and February. Not so good.

Source: National Bureau of Statistics of China.

Last week, the IMF downgraded China’s 2019 growth rate to 6.2%.

If this occurs, China will print its lowest growth rate in around 28 years, according to World Bank and OECD National Accounts data.

Big bites.

As we pointed out in last week’s blog, China’s share of US trade has declined from 14.2% in March 2018 to 11.7% in March 2019 - a year on year drop of ~18%.

And, with the Huawei banning, chances are it will decline further.

Although plans for the 5% tariff on all Mexican goods were ‘suspended indefinitely’ last Friday (and let’s face it, Mexico was smart to ‘stay down’ after the first blow), there is no sign of the Don letting up on China.

The Dragon fights back.

This week the Don said that if President Xi chooses to not meet with him at the G20 at the end of June, he will impose tariffs on at least another US$300 billion of Chinese imports.

In response, the Chinese Foreign Ministry said:

“If the United States only wants to escalate trade frictions, we will resolutely respond and fight to the end.”

Cushion.

On the home front, China is pulling out the cushions for one of its most important sectors - its banking system.

Aside from ‘calming’ markets after the People’s Bank of China had to take over failed Baoshang Bank in May, PBOC has announced more stimulus by expanding its medium term lending facility liquidity pool to 500 billion yuan, and has made it available to a larger list of banks.

Whilst trading the Don, blow for blow, the Dragon is digging in on trade, and appears quite prepared to pump in more liquidity to cushion its slowing economy.

Currency.

What’s becoming interesting again is the extent to which each President will seek to move down interest rates and in turn, currencies.

A weaker yuan makes Chinese imports into the US more attractive as it partially offsets the tariff effect. However, if the US currency also weakens, a US importer still needs more US dollars to buy a cheaper yuan, and so the game turns into who can get cheaper, quicker.

In one corner, the Don continues to impose and threaten tariffs and jawbone down interest rates by attacking the Fed. In the opposing corner, China relies on direct intervention and bank bailouts, and let’s not forget that the Dragon has a very long tail and sharp talons to dig in.

Does anyone still think this is a passing trade skirmish?

Mike.

NextLevelCorporate is a leading strategic corporate advisory firm with a multi-decade track record which speaks for itself. We inject independent and conflict-free Senior Advisor experience and expertise directly into private and public M&A, debt and equity transactions/strategies.